Much has been made with the incessant talk of the FANG leadership in this ongoing bull market rally. AMZN is lower 6 of the last 8 weeks and seems to be failing at the very round 1000 number and is now in correction mode off 10% from most recent all time highs and below its 50 day SMA. While AMZN was able to climb more than 80 handles above 1000 in late July, GOOGL has been repelled there twice with no weekly CLOSES above. The only two that were higher than 1000 intraweek were ending 6/9 and 7/28 and both of those reversed hard falling 2.6 and 3.6% and each one recorded bearish engulfing weekly candles. FB is holding the round 170 number and the last 3 weeks have CLOSED remarkably taut, all within just 1.07 of each other, and it rests just 3% off most recent all time highs. Lets take a look at NFLX which arguably is the best chart of the four. Below is how we looked at the name in our Thursday 8/17 Game Plan and then we take a peek at its present situation.

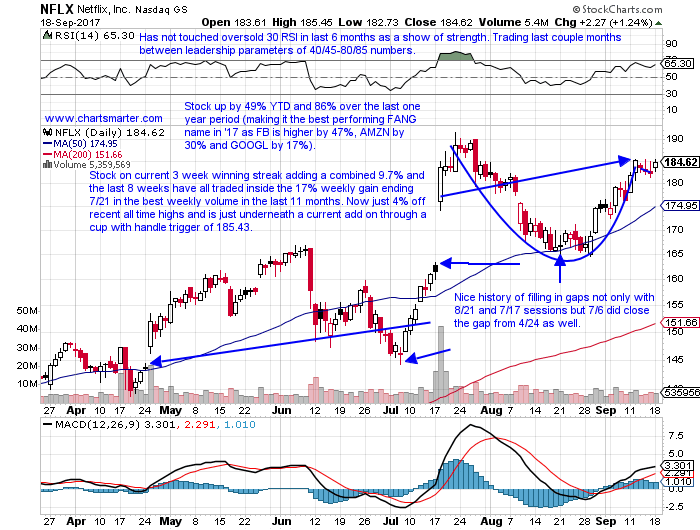

NFLX is a FANG play higher by 37% YTD and 76% over the last one year period. Earnings have been mostly higher with gains of 13.5, 3.9 and 19% on 7/18, 1/19 and 10/18 and a loss of 2.6% on 4/18. The stock is on a 3 week losing streak falling almost a combined 10% and this week is lower by .8% thus far. This comes just after a powerful 3 week winning streak which rose by 25% between weeks ending 7/7-21 with the week ending 7/21 which came on the best weekly trade in 9 months. It now trades 11% off recent all time highs and NFLX broke above a double bottom trigger of 160.07 on 7/14 and today bounced nicely off its rising 50 day SMA which also came close to filling in the 7/17 gap. Enter here.

Trigger NFLX here. Stop 161.

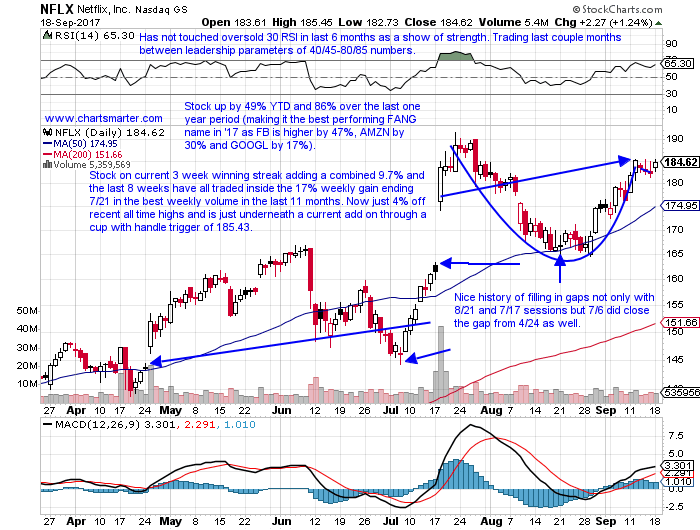

Taking a current look at NFLX it is now up by 49% YTD and 86% over the last one year period (making it the best performing FANG name in '17 as FB is higher by 47%, AMZN by 30% and GOOGL by 17%). It is on a current 3 week winning streak adding a combined 9.7% and the last 8 weeks have all traded inside the 17% weekly gain ending 7/21 in the best weekly volume in the last 11 months. The stock is now just 4% off recent all time highs and is just underneath a current add on through a cup with handle trigger of 185.43.

If you liked what you read why not take a 2 week FREE trial at www.chartsmarter.com.

Much has been made with the incessant talk of the FANG leadership in this ongoing bull market rally. AMZN is lower 6 of the last 8 weeks and seems to be failing at the very round 1000 number and is now in correction mode off 10% from most recent all time highs and below its 50 day SMA. While AMZN was able to climb more than 80 handles above 1000 in late July, GOOGL has been repelled there twice with no weekly CLOSES above. The only two that were higher than 1000 intraweek were ending 6/9 and 7/28 and both of those reversed hard falling 2.6 and 3.6% and each one recorded bearish engulfing weekly candles. FB is holding the round 170 number and the last 3 weeks have CLOSED remarkably taut, all within just 1.07 of each other, and it rests just 3% off most recent all time highs. Lets take a look at NFLX which arguably is the best chart of the four. Below is how we looked at the name in our Thursday 8/17 Game Plan and then we take a peek at its present situation.

NFLX is a FANG play higher by 37% YTD and 76% over the last one year period. Earnings have been mostly higher with gains of 13.5, 3.9 and 19% on 7/18, 1/19 and 10/18 and a loss of 2.6% on 4/18. The stock is on a 3 week losing streak falling almost a combined 10% and this week is lower by .8% thus far. This comes just after a powerful 3 week winning streak which rose by 25% between weeks ending 7/7-21 with the week ending 7/21 which came on the best weekly trade in 9 months. It now trades 11% off recent all time highs and NFLX broke above a double bottom trigger of 160.07 on 7/14 and today bounced nicely off its rising 50 day SMA which also came close to filling in the 7/17 gap. Enter here.

Trigger NFLX here. Stop 161.

Taking a current look at NFLX it is now up by 49% YTD and 86% over the last one year period (making it the best performing FANG name in '17 as FB is higher by 47%, AMZN by 30% and GOOGL by 17%). It is on a current 3 week winning streak adding a combined 9.7% and the last 8 weeks have all traded inside the 17% weekly gain ending 7/21 in the best weekly volume in the last 11 months. The stock is now just 4% off recent all time highs and is just underneath a current add on through a cup with handle trigger of 185.43.

If you liked what you read why not take a 2 week FREE trial at www.chartsmarter.com.