Markets are still in selloff mode as November comes to an end. Investors endured a miserable October, and many were relieved once November commenced. Perhaps they are not feeling as jolly as they wanted as the Nasdaq is now off 14% from most recent 52 week highs, well into correction mode. The S&P 500 is 10% off most recent highs and is has descended 3.2% this week thus far compared to the Nasdaq which has slipped 3.8%. We still maintain a very cautious stance, but must remain openminded to a year end rally, as we know the markets tend to confound the most. Below are two names that have held up relatively well, and their charts should not be overlooked.

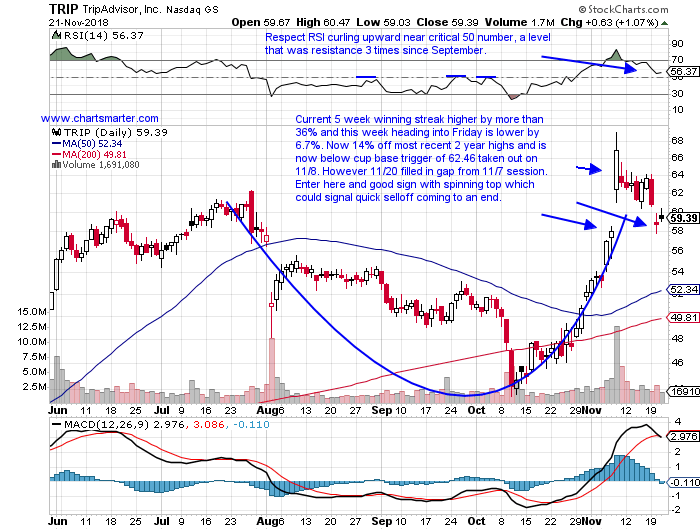

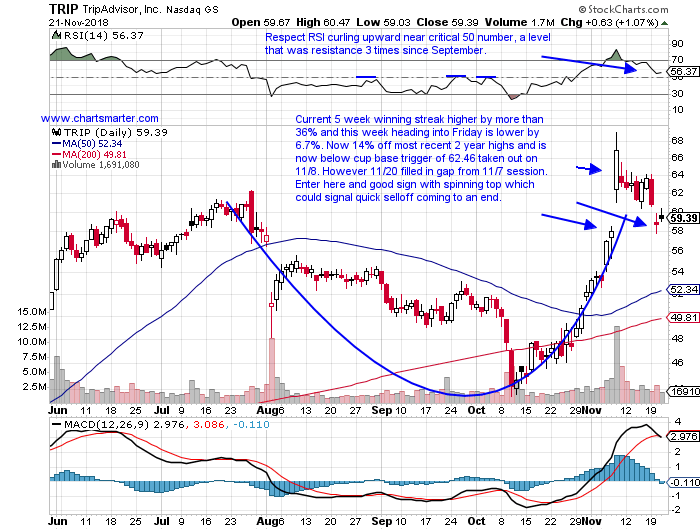

Name was UP 2% in October, shrugging off overall market weakness. TRIP is a best in breed leisure play higher by 72% YTD and 81% over the last one year period. Earnings have been mostly higher with nice gains of 15.3, 22.8 and 4.1% on 11/8, 5/9 and 2/15 and a loss of 11.2% on 8/2. The stock is on a current 5 week winning streak higher by more than a combined 36%, but this week heading into Friday is lower by 6.7%. It is now 14% off most recent 2 year highs and is below a cup base trigger of 62.46 taken out on 11/8, but Tuesday TRIP filled in a gap from the 11/7 session. So those that missed the earnings jump can enter here with a decent risk/reward scenario.

Trigger TRIP here. Stop 56.

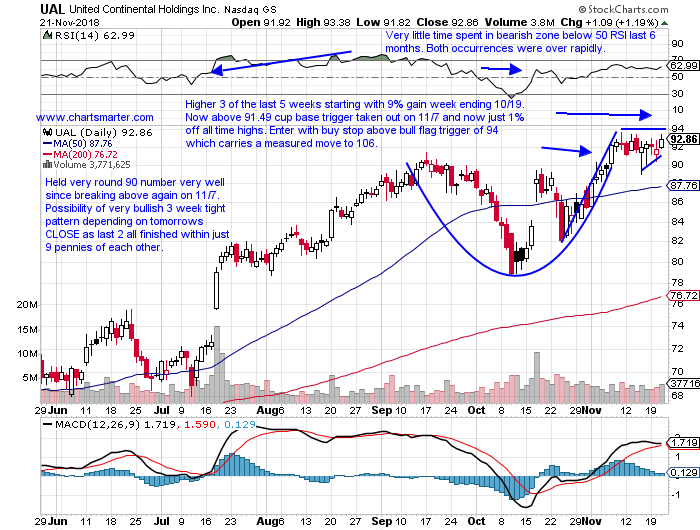

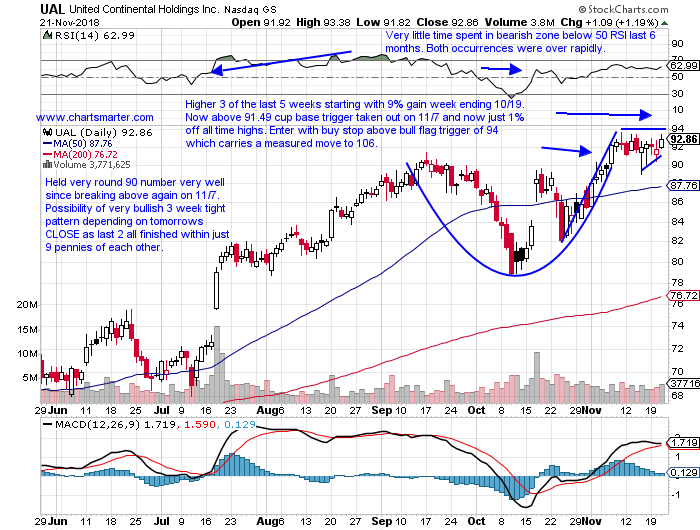

Excellent relative strength compared with JETS ETF which is presently lower by 11% from most recent 52 week highs. UAL is an airliner leader higher by 38% YTD and 56% over the last one year period. Earnings are well on the mend with three consecutive respectable gains of 5.9, 8.8 and 4.8% on 10/17, 7/18 and 4/18 after back to back double digit losses of 11.4 and 12.1% on 1/24 and 10/19/17. The stock is higher 3 of the last 5 weeks, beginning with a 9% weekly gain ending 10/19 in firm trade. It is now above a 91.49 cup base trigger taken out on 11/7 and it trades just 1% off most recent all time highs. Enter UAL with a buy stop above a bull flag trigger of 94 which carries a measured move to 106.

Trigger UAL 94. Stop 91.

Good luck.

Markets are still in selloff mode as November comes to an end. Investors endured a miserable October, and many were relieved once November commenced. Perhaps they are not feeling as jolly as they wanted as the Nasdaq is now off 14% from most recent 52 week highs, well into correction mode. The S&P 500 is 10% off most recent highs and is has descended 3.2% this week thus far compared to the Nasdaq which has slipped 3.8%. We still maintain a very cautious stance, but must remain openminded to a year end rally, as we know the markets tend to confound the most. Below are two names that have held up relatively well, and their charts should not be overlooked.

Name was UP 2% in October, shrugging off overall market weakness. TRIP is a best in breed leisure play higher by 72% YTD and 81% over the last one year period. Earnings have been mostly higher with nice gains of 15.3, 22.8 and 4.1% on 11/8, 5/9 and 2/15 and a loss of 11.2% on 8/2. The stock is on a current 5 week winning streak higher by more than a combined 36%, but this week heading into Friday is lower by 6.7%. It is now 14% off most recent 2 year highs and is below a cup base trigger of 62.46 taken out on 11/8, but Tuesday TRIP filled in a gap from the 11/7 session. So those that missed the earnings jump can enter here with a decent risk/reward scenario.

Trigger TRIP here. Stop 56.

Excellent relative strength compared with JETS ETF which is presently lower by 11% from most recent 52 week highs. UAL is an airliner leader higher by 38% YTD and 56% over the last one year period. Earnings are well on the mend with three consecutive respectable gains of 5.9, 8.8 and 4.8% on 10/17, 7/18 and 4/18 after back to back double digit losses of 11.4 and 12.1% on 1/24 and 10/19/17. The stock is higher 3 of the last 5 weeks, beginning with a 9% weekly gain ending 10/19 in firm trade. It is now above a 91.49 cup base trigger taken out on 11/7 and it trades just 1% off most recent all time highs. Enter UAL with a buy stop above a bull flag trigger of 94 which carries a measured move to 106.

Trigger UAL 94. Stop 91.

Good luck.