Energy Review:

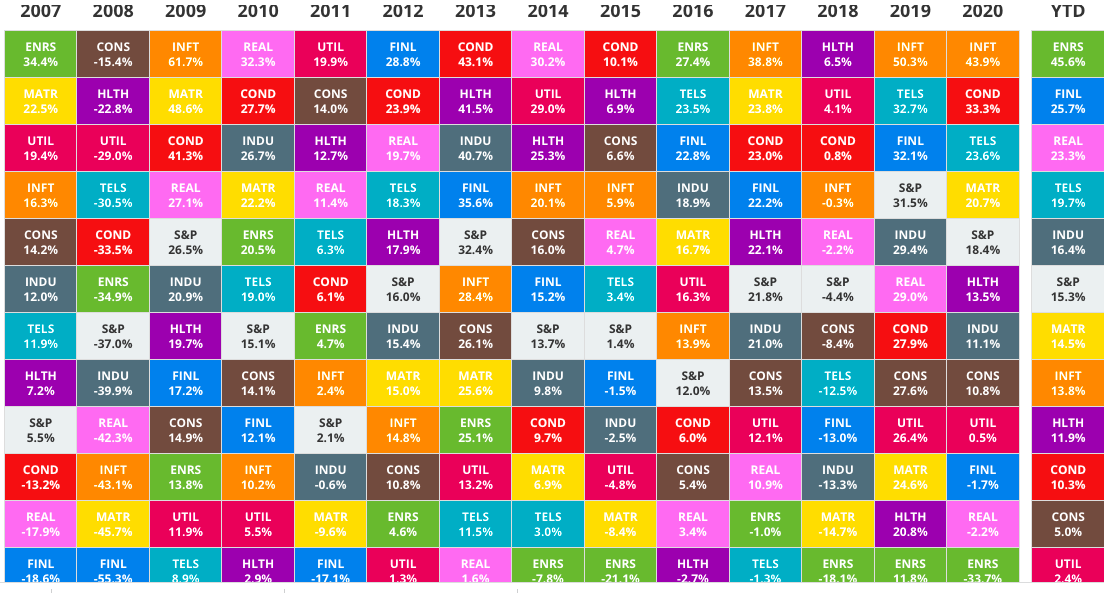

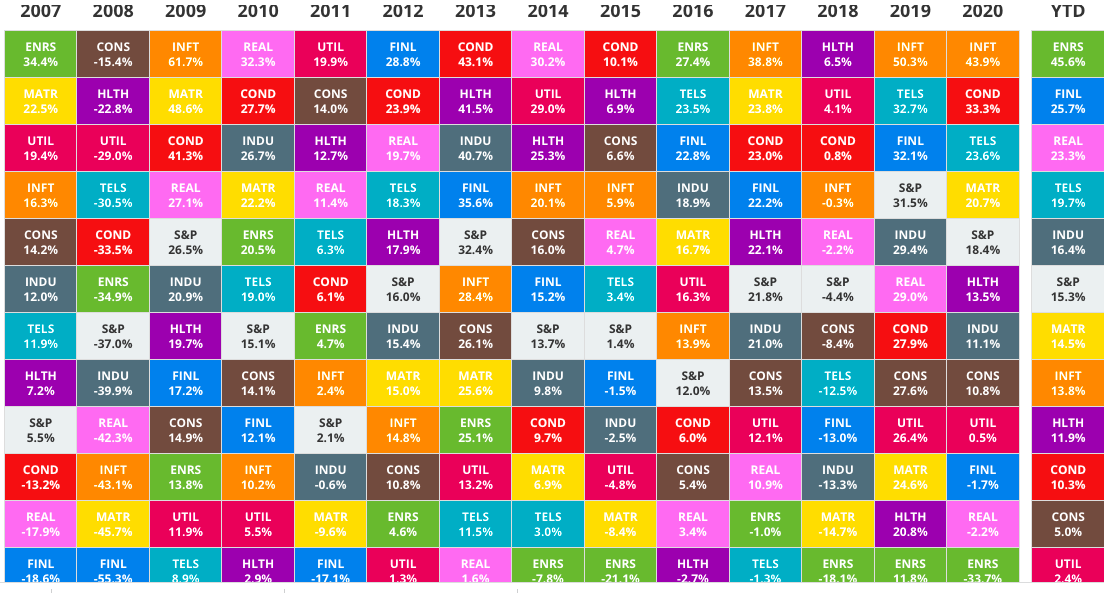

- Notice the hit or miss nature of the group. Six of the last 7 years sector was the worst or second-worst major S&P actor of 11. Great action this year obviously and last 2 times it was the best behaved on a YTD basis in 2007 and 2016 the XLE fell the next year.

Relative Performance:

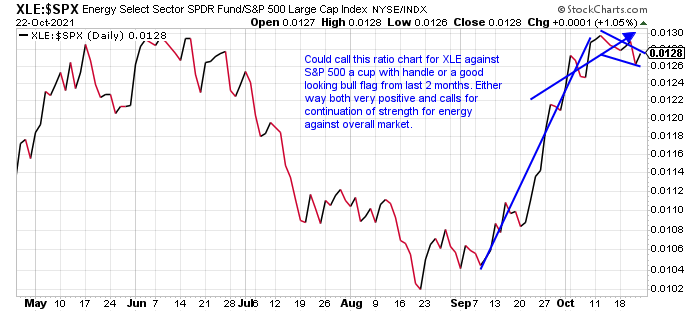

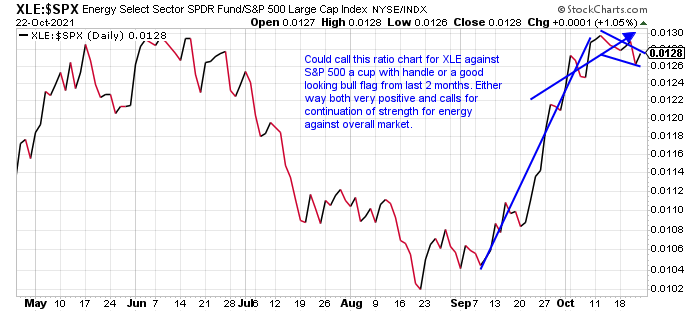

- Like we saw above the XLE is best performing major sector in 2021 with just 2 months left. XLE up 53% YTD (dividend yield of 3.7%). XOP has advanced by 83% and OIH by 44% respectively. XLE on current 6-week winning streak with last 5 all CLOSING at highs for WEEKLY range.

Individual Names:

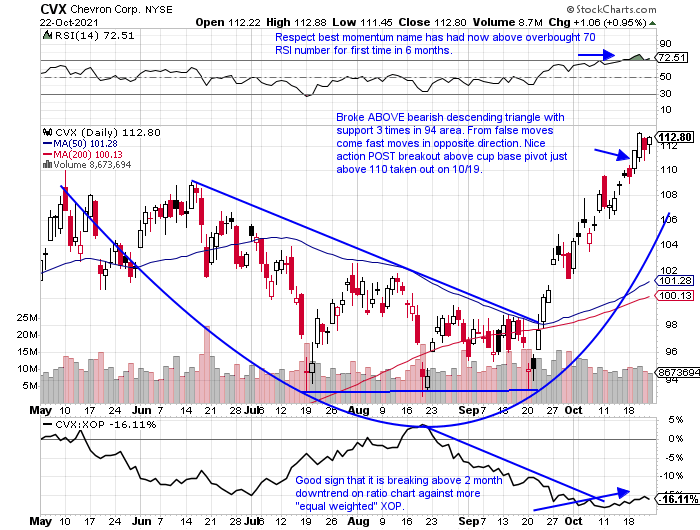

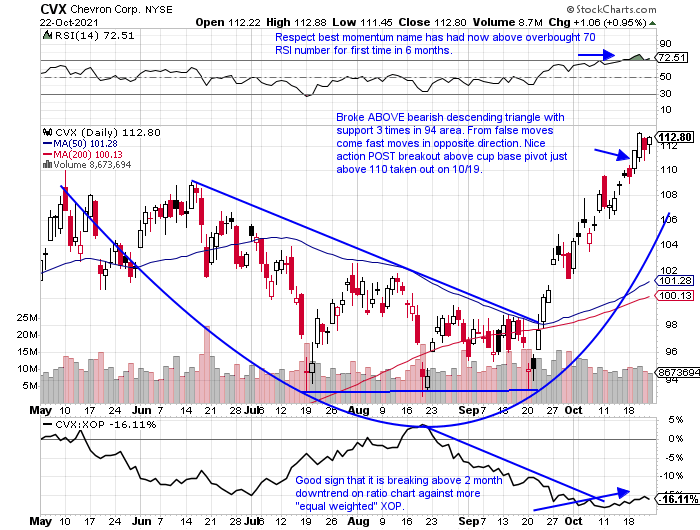

- Mega cap has lagged in 2021 higher by 34% but strong dividend yield of 4.75%.

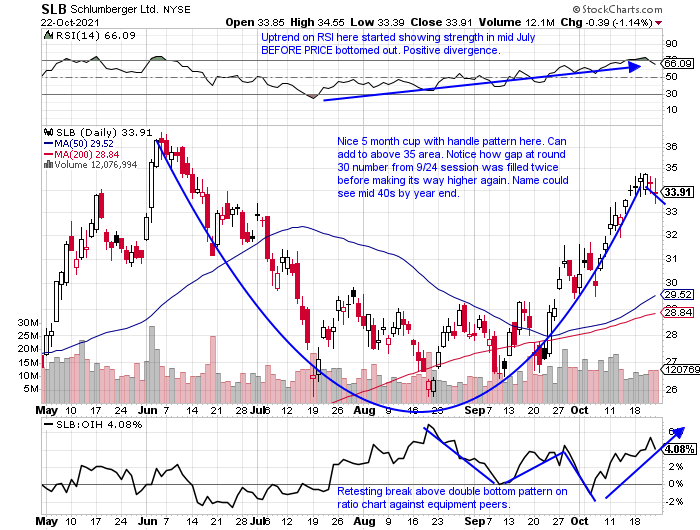

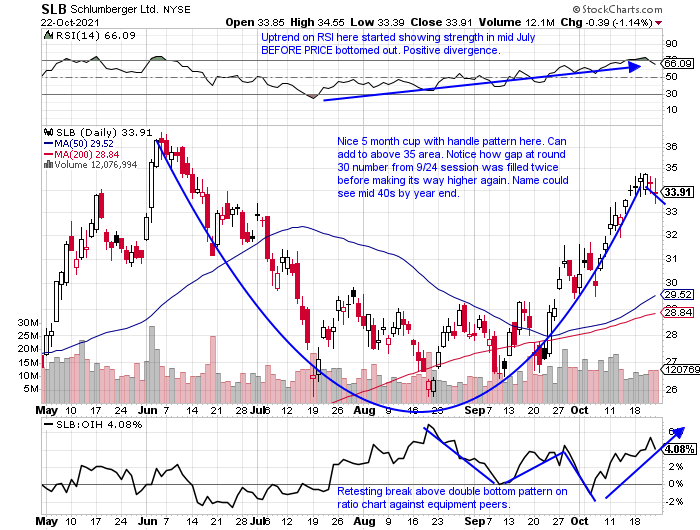

- Outperforming equipment peers up 55% YTD and this past week was UNCH after prior 3 all rose in well above average WEEKLY volume and by a combined 16%.

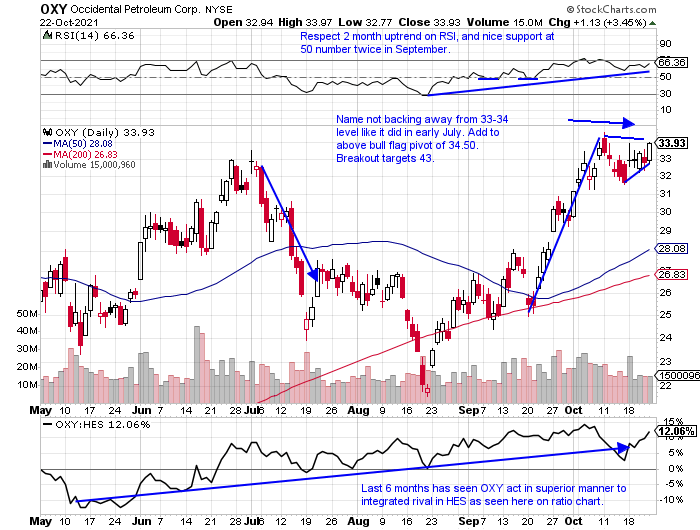

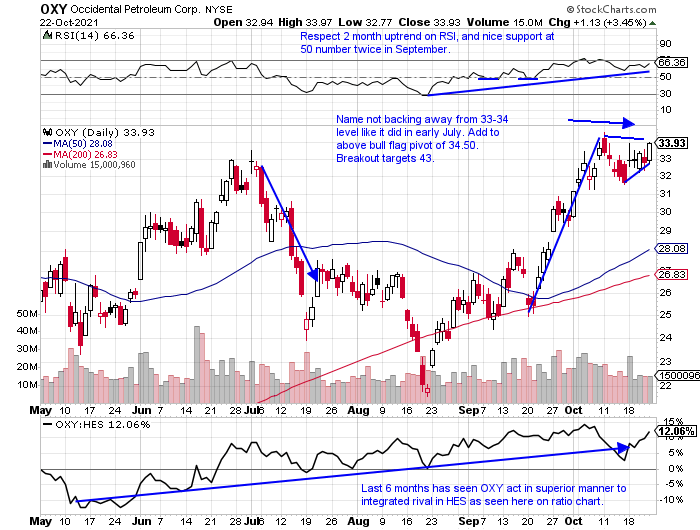

- Stock rose more than 7% last week after prior week recorded bearish engulfing candle. Good recent digestion after 3 weeks ending between 9/24-10/8 rose by a combined 23%.

This article requires a Chartsmarter membership. Please click here to join.

Energy Review:

- Notice the hit or miss nature of the group. Six of the last 7 years sector was the worst or second-worst major S&P actor of 11. Great action this year obviously and last 2 times it was the best behaved on a YTD basis in 2007 and 2016 the XLE fell the next year.

Relative Performance:

- Like we saw above the XLE is best performing major sector in 2021 with just 2 months left. XLE up 53% YTD (dividend yield of 3.7%). XOP has advanced by 83% and OIH by 44% respectively. XLE on current 6-week winning streak with last 5 all CLOSING at highs for WEEKLY range.

Individual Names:

- Mega cap has lagged in 2021 higher by 34% but strong dividend yield of 4.75%.

- Outperforming equipment peers up 55% YTD and this past week was UNCH after prior 3 all rose in well above average WEEKLY volume and by a combined 16%.

- Stock rose more than 7% last week after prior week recorded bearish engulfing candle. Good recent digestion after 3 weeks ending between 9/24-10/8 rose by a combined 23%.