Industrial Revolution:

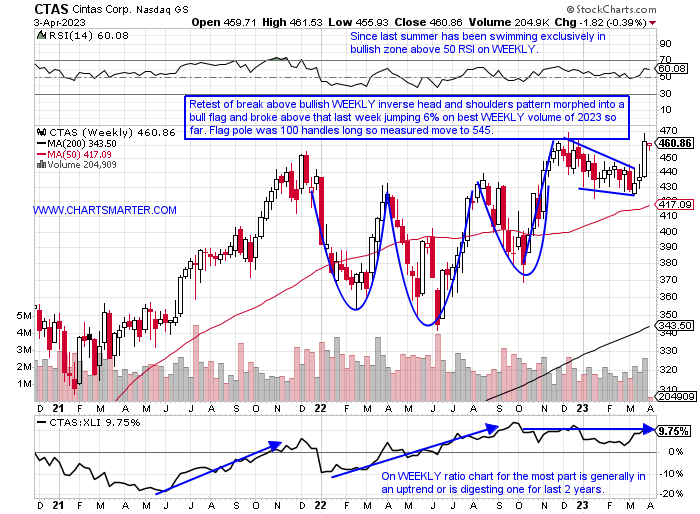

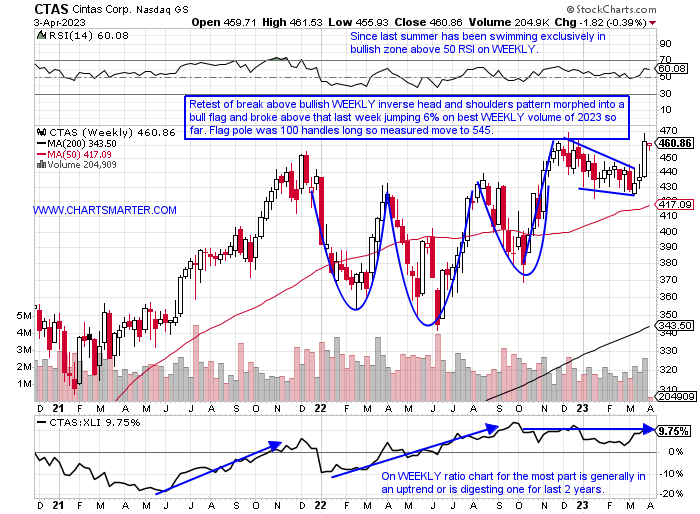

- Can there be a "rolling" bull market within a specific sector? Overall the industrials are holding up just fine as we discussed in our WEEK AHEAD Note this weekend. Monday the XLI narrowly extended its daily winning session streak to 7. But some groups within shined, including defense with the ITA up 1.6%. Waste and disposal services have been soft for much of 2023, as have railroads and airlines. Delivery services that were weak are now the best acting subsector within the group with giants FDX and UPS each 8% off their most recent 52-week highs. Perhaps business support services will be ready to take the leadership baton while other leading spaces inside the XLI get a well-deserved rest. Below is the WEEKLY chart of CTAS which is right at all-time highs and is a good indication of how small businesses around the country are doing as they help with uniforms and other items necessary for them to survive. Irish small-cap CMPR, a maker of business cards, jumped 40% last week. LZ is attempting to rid itself of single-digit status as it tries to break above its 200-day SMA for the first time ever.

"Cementing" The Bullish Economic Stance:

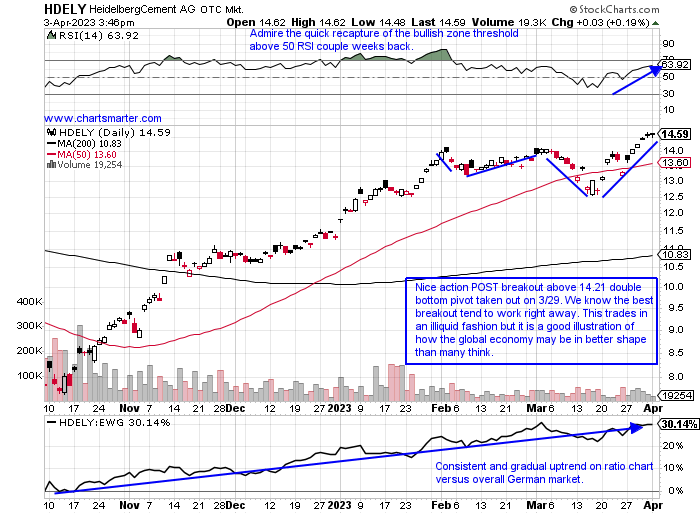

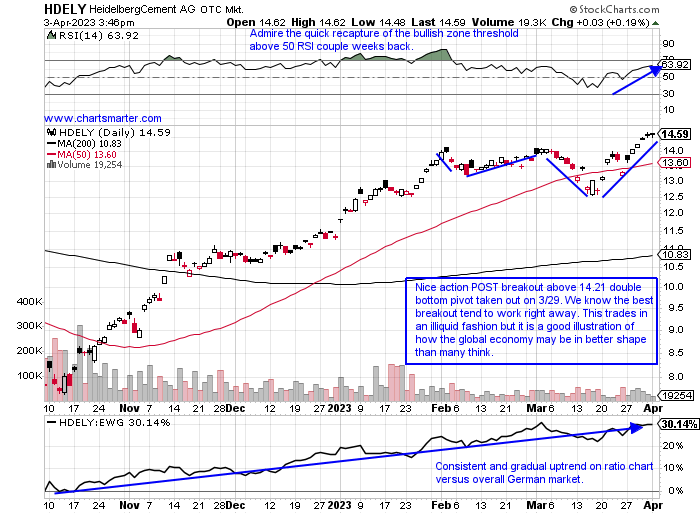

- Keeping openminded when there is doom and gloom in the media on a daily basis can pay dividends. Again I just pay attention to PRICE action as stocks do not lie, simply put people do. If one were to look at the behavior of a couple of international cement plays, there are few pure plays on this, they would come away impressed. South of the border we have Cemex and CX is up 33% in 2023 thus far. Since a double bottom near the 3.20 level last June and October, it rose to a peak of 5.71 in March, a gain of almost 80%. Its WEEKLY chart sports a bull flag pattern a move above 5.75 would carry a move close to 8. Below is a daily chart of the German play in HeidelbergCement and it too is behaving itself having almost doubled from the late September lows last year. The WEEKLY chart is sporting a bullish inverse head and shoulders pattern and a break above the rough 14 area carries a measured move to 21. It is higher by 29% this year, double that of the DAX, and pays a dividend yield of 2.5%.

Recent Examples:

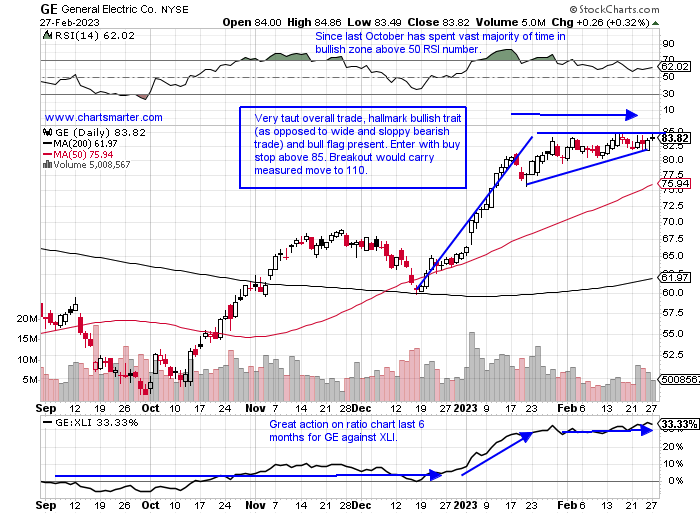

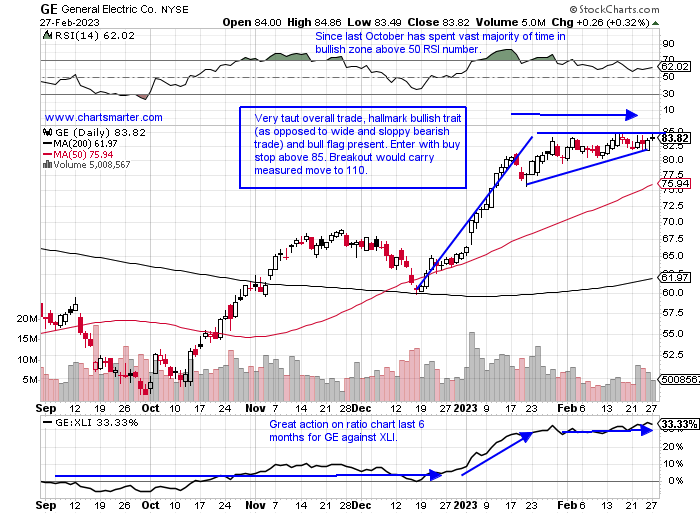

- Sometimes former leaders regain their "general" status. It is very rare but it does occur. A good example of that may be the chart below of GE and how it appeared in our 2/28 Industrial Note (the last one we did on the sector). This particular name has undergone some transformation to do so, which may have helped, most recently with the spin-off of its healthcare unit. GEHC in its relatively short time of trading has advanced in 13 of the last 15 weeks. Getting back to the chart of GE this name has acted in a very positive manner. This year so far the stock has fallen on a WEEKLY basis just 4 times and it has doubled since the early October lows of 2022. Last week it jumped almost 5% clearing a 3-week tight pattern as the prior 3 weeks ending between 3/1-24 all CLOSED within just 1.08 of each other. On its WEEKLY chart it also decisively cleared the very round 90 number which was resistance three times in 2021.

Special Situations:

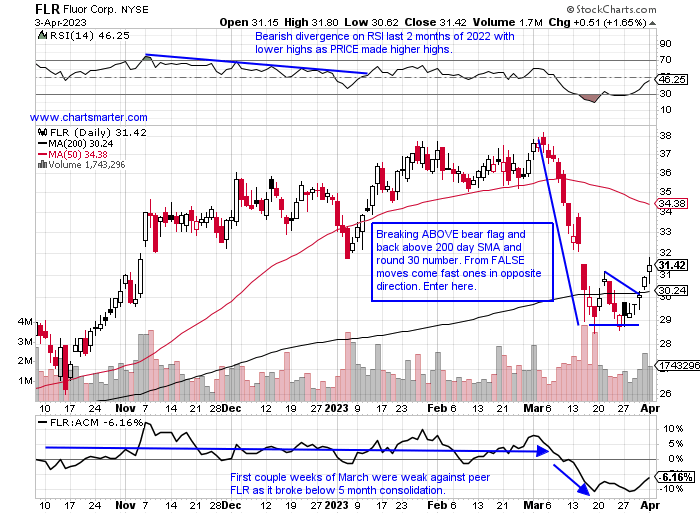

Fluor:

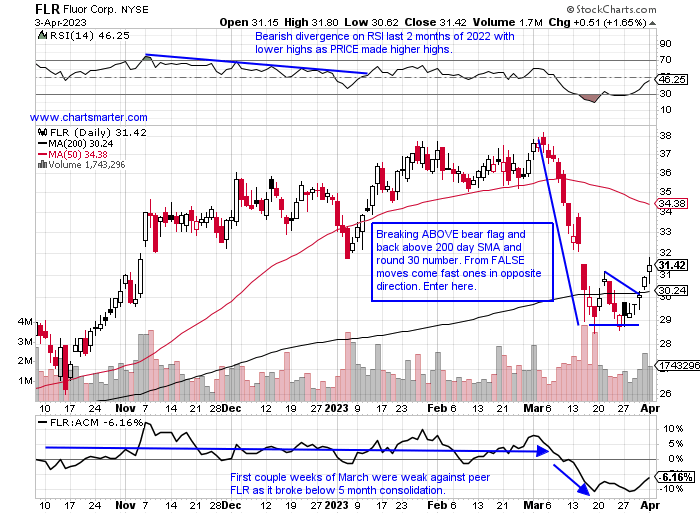

- Heavy construction play down 9% YTD and up 7% over last one year period.

- Name 18% off most recent 52-week highs and bullish morning star WEEKLY candle completed last week. Finding support here at 50 WEEK SMA, a line that has been comforting since early 2022.

- Earnings reactions mixed up 6.1 and 3.2% on 11/4 and 5/6/22 and losses of .2 and 9.1% on 2/21 and 8/5/22.

- Enter after break ABOVE bear flag.

- Entry FLR here. Stop 29.

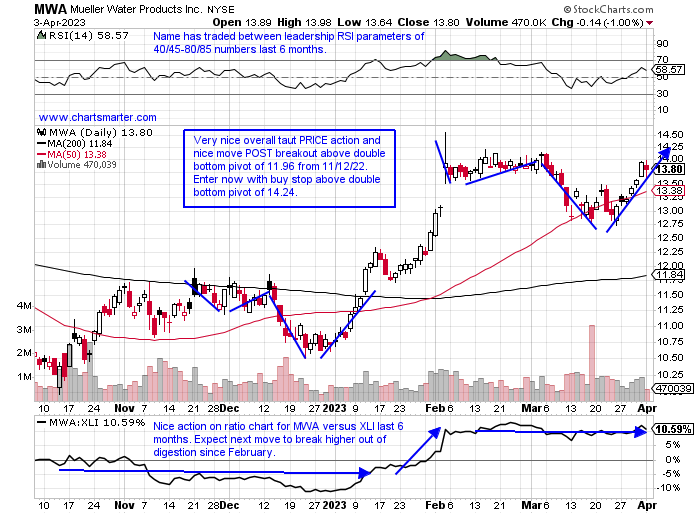

Mueller Water Products:

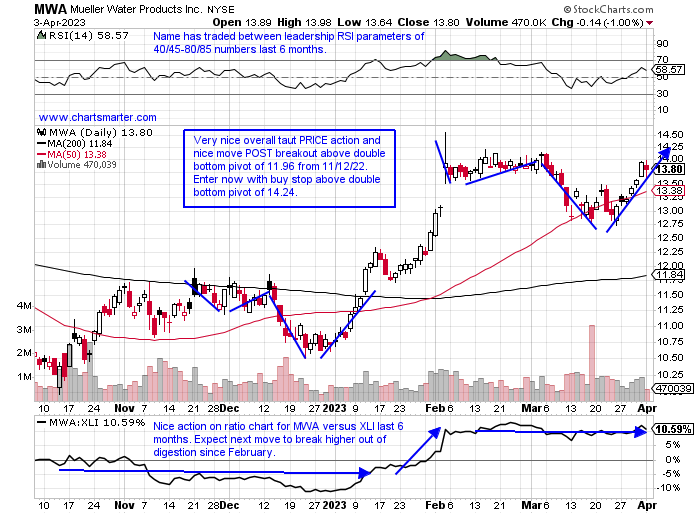

- Specialty industrial machinery play up 28% YTD and 6% over last one year period. Dividend yield of 1.8%.

- Name 6% off most recent 52-week highs and last 7 weeks have essentially been digesting big move during 4 of 5 week winning streak weeks ending between 1/6-2/3 that rose by a combined 37% from top to bottom of range.

- Earnings reactions mostly down 2.9, 9.8, and 3.5% on 11/8, 8/5, and 5/3/22 before recent gain of 6.7% on 2/3.

- Enter with buy stop above double bottom pivot.

- Entry MWA 14.24. Stop 13.40.

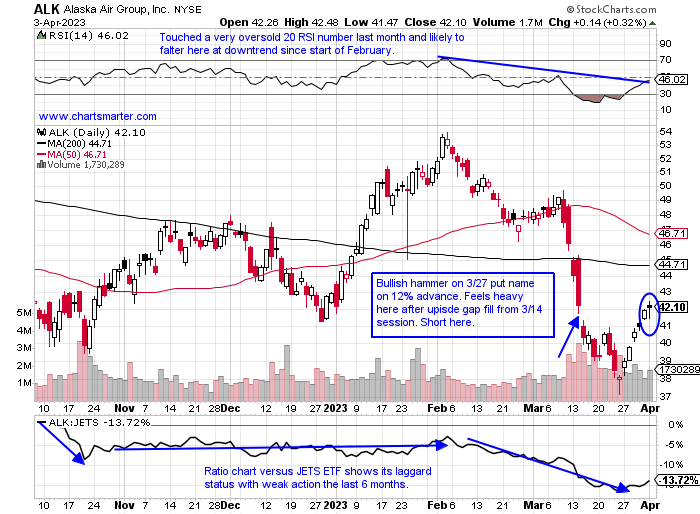

Alaska Air:

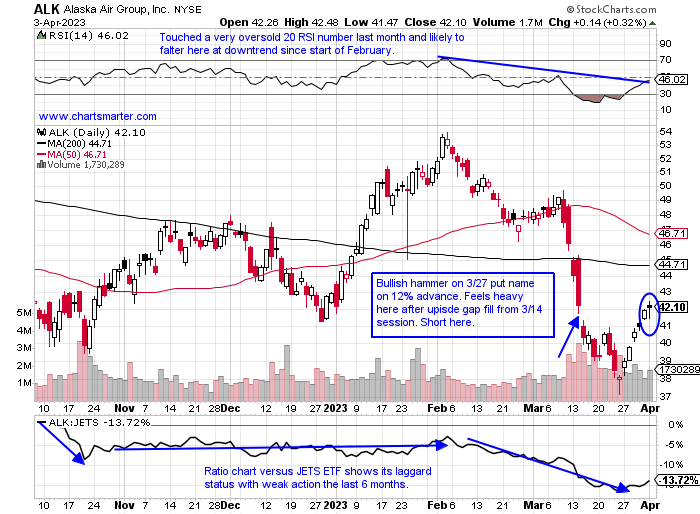

- Airline laggard down 2% YTD and 27% over last one year period.

- Name 31% off most recent 52-week highs and has declined 6 of the last 8 weeks with 3 weeks ending between 3/10-24 falling by a 22% combined alone. Last week did jump 10%.

- Earnings reactions mixed up .5 and .1% on 1/26 and 4/21/22 and fell 4.7 and .5% on 10/20 and 7/21/22.

- Enter short into upside gap fill.

- Entry ALK here. Buy stop 43.75.

Good luck.

Entry summaries:

Buy after break ABOVE bear flag FLR here. Stop 29.

Buy stop above double bottom pivot MWA 14.24. Stop 13.40.

Short into upside gap fill ALK here. Buy stop 43.75.

This article requires a Chartsmarter membership. Please click here to join.

Industrial Revolution:

- Can there be a "rolling" bull market within a specific sector? Overall the industrials are holding up just fine as we discussed in our WEEK AHEAD Note this weekend. Monday the XLI narrowly extended its daily winning session streak to 7. But some groups within shined, including defense with the ITA up 1.6%. Waste and disposal services have been soft for much of 2023, as have railroads and airlines. Delivery services that were weak are now the best acting subsector within the group with giants FDX and UPS each 8% off their most recent 52-week highs. Perhaps business support services will be ready to take the leadership baton while other leading spaces inside the XLI get a well-deserved rest. Below is the WEEKLY chart of CTAS which is right at all-time highs and is a good indication of how small businesses around the country are doing as they help with uniforms and other items necessary for them to survive. Irish small-cap CMPR, a maker of business cards, jumped 40% last week. LZ is attempting to rid itself of single-digit status as it tries to break above its 200-day SMA for the first time ever.

"Cementing" The Bullish Economic Stance:

- Keeping openminded when there is doom and gloom in the media on a daily basis can pay dividends. Again I just pay attention to PRICE action as stocks do not lie, simply put people do. If one were to look at the behavior of a couple of international cement plays, there are few pure plays on this, they would come away impressed. South of the border we have Cemex and CX is up 33% in 2023 thus far. Since a double bottom near the 3.20 level last June and October, it rose to a peak of 5.71 in March, a gain of almost 80%. Its WEEKLY chart sports a bull flag pattern a move above 5.75 would carry a move close to 8. Below is a daily chart of the German play in HeidelbergCement and it too is behaving itself having almost doubled from the late September lows last year. The WEEKLY chart is sporting a bullish inverse head and shoulders pattern and a break above the rough 14 area carries a measured move to 21. It is higher by 29% this year, double that of the DAX, and pays a dividend yield of 2.5%.

Recent Examples:

- Sometimes former leaders regain their "general" status. It is very rare but it does occur. A good example of that may be the chart below of GE and how it appeared in our 2/28 Industrial Note (the last one we did on the sector). This particular name has undergone some transformation to do so, which may have helped, most recently with the spin-off of its healthcare unit. GEHC in its relatively short time of trading has advanced in 13 of the last 15 weeks. Getting back to the chart of GE this name has acted in a very positive manner. This year so far the stock has fallen on a WEEKLY basis just 4 times and it has doubled since the early October lows of 2022. Last week it jumped almost 5% clearing a 3-week tight pattern as the prior 3 weeks ending between 3/1-24 all CLOSED within just 1.08 of each other. On its WEEKLY chart it also decisively cleared the very round 90 number which was resistance three times in 2021.

Special Situations:

Fluor:

- Heavy construction play down 9% YTD and up 7% over last one year period.

- Name 18% off most recent 52-week highs and bullish morning star WEEKLY candle completed last week. Finding support here at 50 WEEK SMA, a line that has been comforting since early 2022.

- Earnings reactions mixed up 6.1 and 3.2% on 11/4 and 5/6/22 and losses of .2 and 9.1% on 2/21 and 8/5/22.

- Enter after break ABOVE bear flag.

- Entry FLR here. Stop 29.

Mueller Water Products:

- Specialty industrial machinery play up 28% YTD and 6% over last one year period. Dividend yield of 1.8%.

- Name 6% off most recent 52-week highs and last 7 weeks have essentially been digesting big move during 4 of 5 week winning streak weeks ending between 1/6-2/3 that rose by a combined 37% from top to bottom of range.

- Earnings reactions mostly down 2.9, 9.8, and 3.5% on 11/8, 8/5, and 5/3/22 before recent gain of 6.7% on 2/3.

- Enter with buy stop above double bottom pivot.

- Entry MWA 14.24. Stop 13.40.

Alaska Air:

- Airline laggard down 2% YTD and 27% over last one year period.

- Name 31% off most recent 52-week highs and has declined 6 of the last 8 weeks with 3 weeks ending between 3/10-24 falling by a 22% combined alone. Last week did jump 10%.

- Earnings reactions mixed up .5 and .1% on 1/26 and 4/21/22 and fell 4.7 and .5% on 10/20 and 7/21/22.

- Enter short into upside gap fill.

- Entry ALK here. Buy stop 43.75.

Good luck.

Entry summaries:

Buy after break ABOVE bear flag FLR here. Stop 29.

Buy stop above double bottom pivot MWA 14.24. Stop 13.40.

Short into upside gap fill ALK here. Buy stop 43.75.