"Old Tech" Shortcomings:

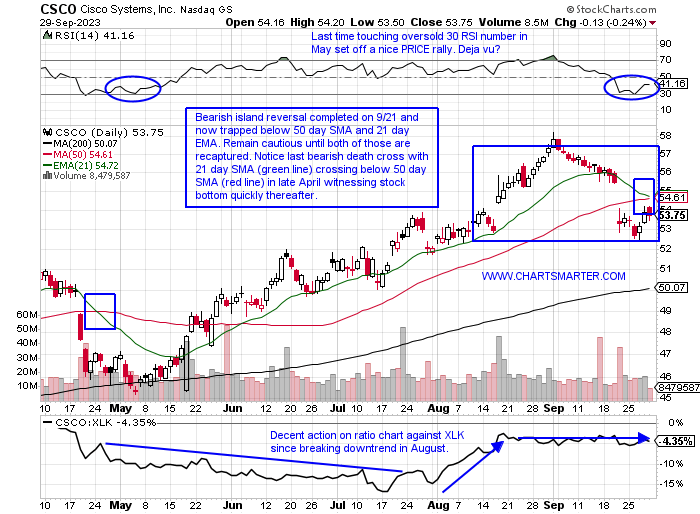

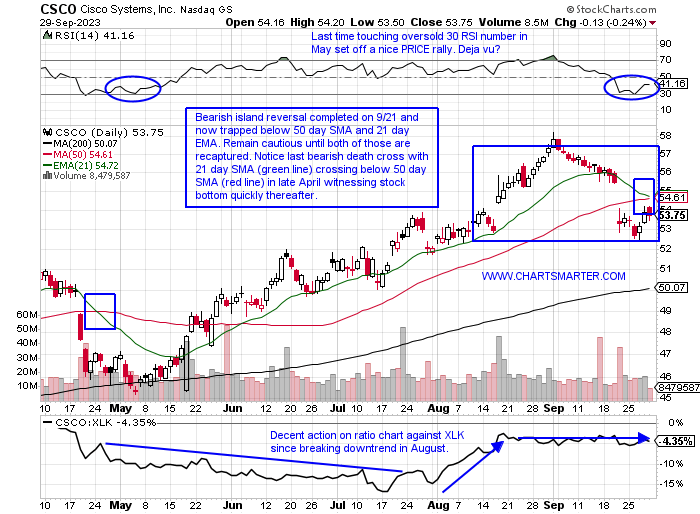

- The mature, "old tech" stocks once totally in vogue are suddenly becoming shunned. They were not too long ago clamored for their defensive nature and dividend yields, but not any longer as the overall market has been shaken out too. HPQ can not blame the recent market fragilities for its softness. Its weakness began with a bearish dark cloud cover candle on 7/12 and has now shaved one-quarter off its value during a current 7-week losing streak. The stock pays a dividend yield of 4%. ORCL slumped 13% after an ill-received earnings reaction on 9/12 and it looks like it is on a collision course with the very round par number near its 200-day SMA. IBM slumped nearly 5% this week after the prior week recorded a double top just above the 150 level and it is on a 7-session losing streak. Below is the chart of CSCO and on 9/21 it completed a bearish island reversal (following the gap up on 8/17) after announcing it was purchasing SPLK. I prefer to act on these events on more mundane, generic news but this is starting to take on the look of a bear flag as well.

Seasonality Tailwinds:

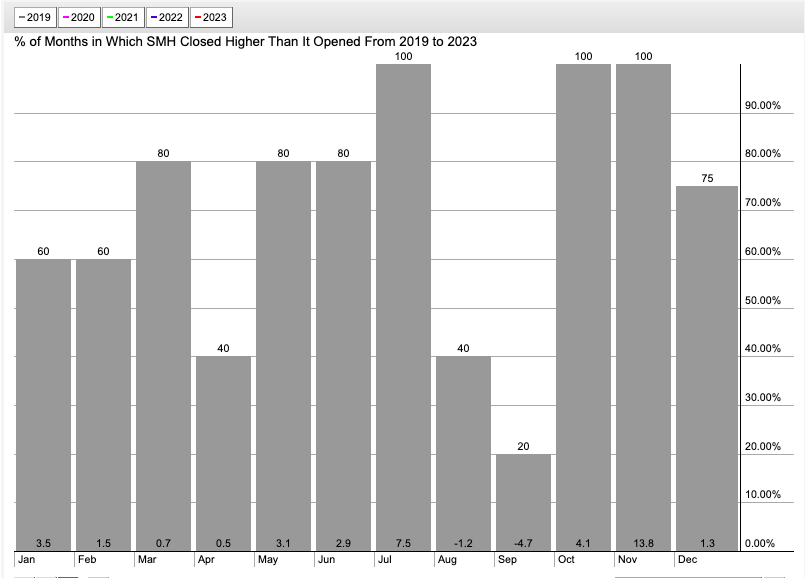

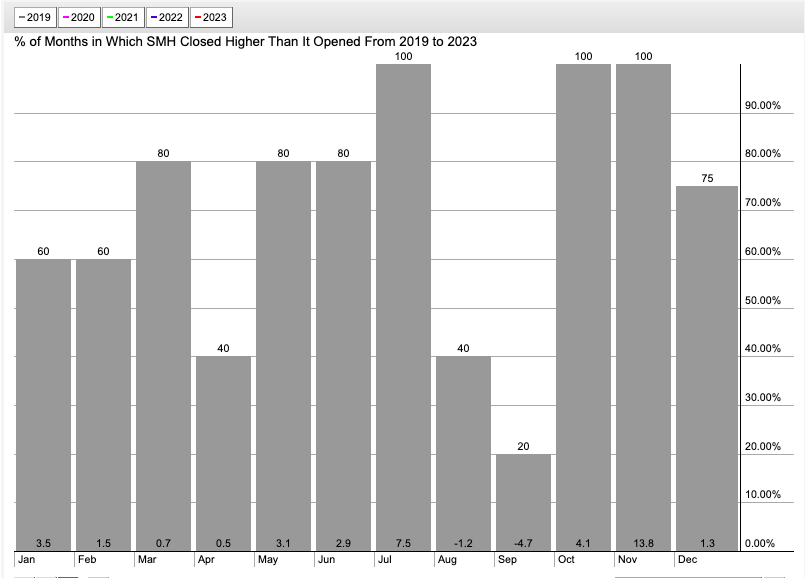

- Semiconductors are an integral part of the technology space. They will often dictate the direction of the entire group and although we are all aware of how positive seasonality factors are as we usher in Q4, I did not realize just how strong they were. Starting with October over the last 4 years, it begins a period of 10 straight MONTHLY advances (where the SMH CLOSES higher than where it opened) and of course, that includes the COVID era. But more specifically the next 2 months are by far the most powerful with the October-November period averaging a combined gain of 19%, not a typo, with all of the 4 years CLOSING above where they started 100% of the time. This September lived up to its reputation of being the worst of the year up just 1 of the last 5 years and averaging a loss of nearly 5%. The 3 weeks ending between 9/8-22 lost nearly a total of 10% alone. Are too many banking on the traditional run into the final quarter or will seasonality play its familiar role? Stay tuned.

Recent Examples:

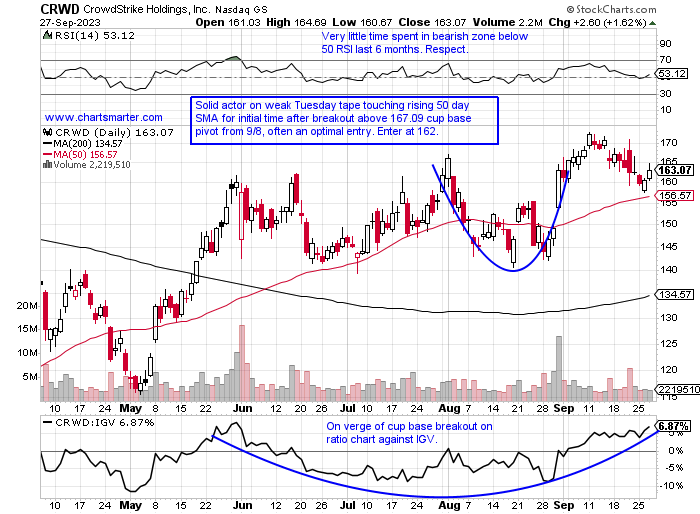

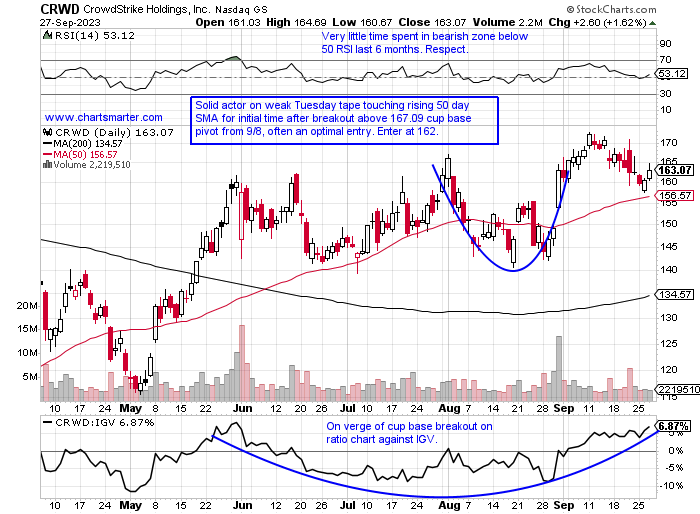

- As software attempts to stay above its August lows that we spoke about this week, I believe one could make small purchases in leaders. Some tried to put up strong moves today like PLTR but CLOSED off intraday highs to end Q3 Friday. Below is the chart of CRWD and how it appeared in our 9/28 Technology Note. This is a name that is easily classified as a leader and this past week it displayed solid relative strength up 3% while the IGV was UNCH. All of the last 4 weeks CLOSED above the top of the WEEKLY range ending 9/1 which jumped 8% in double average WEEKLY volume. The 160 level where the stock was rebuffed 4 times between late May and August now feels like a floor, or at least a very good area to play against. And as generals often do it is offering an add-on buy point on the way up through a short double bottom pivot of 171.10.

Special Situations:

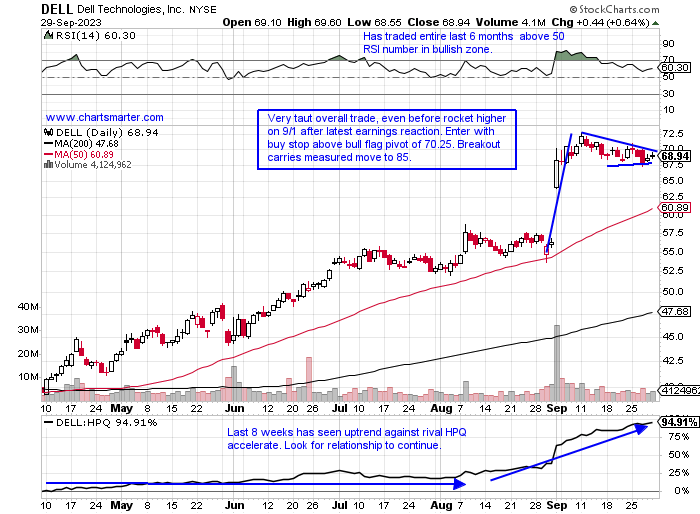

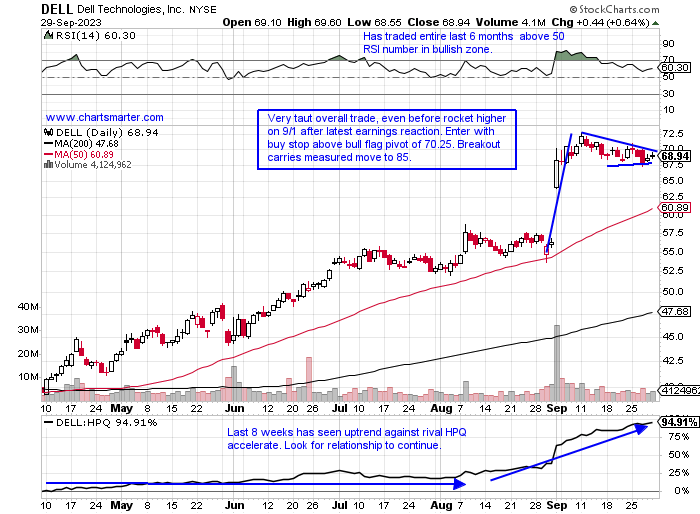

Dell:

- "Old tech" play up 71% YTD and 101% over last one year period. Dividend yield of 2.1%.

- Name 6% off most recent 52-week highs (rival HPQ 24% off its annual peak and on a 7-week losing streak) and has doubled since the March lows. Digesting enormous WEEKLY cup base breakout that began at the beginning of 2022.

- Earnings reactions mostly higher up 21.2, 1.4, and 6.8% on 9/1, 6/2, and 11/22/22, and fell .9% on 3/3.

- Enter with buy stop above bull flag pivot.

- Entry DELL 70.25. Stop 67.50.

Teladoc Health:

- Software laggard down 21% YTD and 29% over the last one year period.

- Name 46% off most recent 52-week highs and much further off highs at very round 300 number from early 2021. Last week was fell 1% (on 4 week losing streak), making up none of the prior 3 weeks losing a combined 20%.

- Earnings reactions mostly higher up 26.9, 6.4, and 6.5% on 7/26, 4/27, and 10/27/22, and fell 6.8% on 2/23.

- Enter short with sell stop below bear flag.

- Entry TDOC 18.40. Buy stop 19.25.

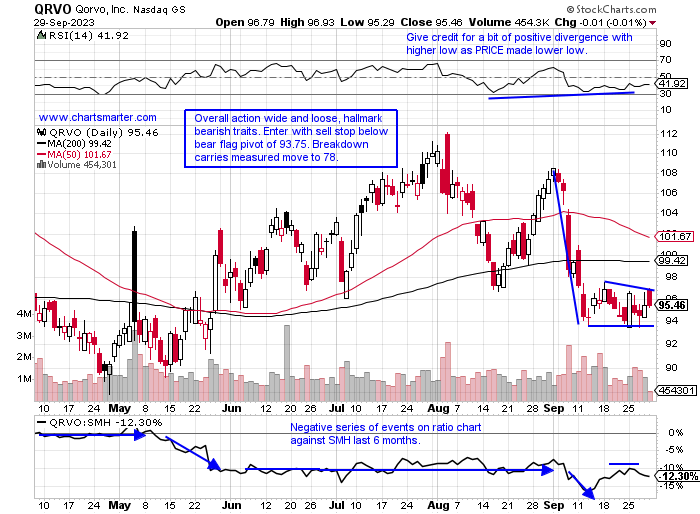

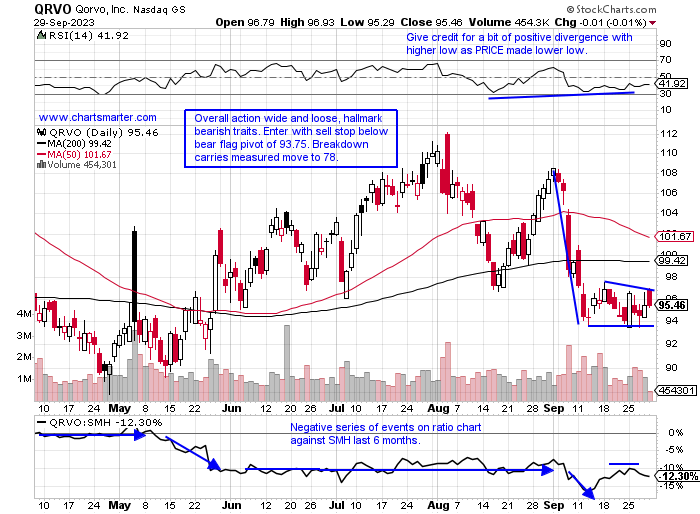

Qorvo:

- Semi laggard up 6% YTD and 17% over last one year period.

- Name 17% off most recent 52-week highs and weak relative strength the 2 weeks ending between 9/8-15 falling a combined 12%, with the SMH falling half that amount. Has look off falling BELOW bullish WEEKLY ascending triangle.

- Earnings reactions mostly lower off .2, 5.8 and 2.1% on 8/3, 2/2 and 11/3/22 and rose .4% on 5/4.

- Enter short with sell stop below bear flag.

- Entry QRVO 93.75. Buy stop 97.50.

Good luck.

Entry summaries:

Buy stop above bull flag pivot DELL 70.25. Stop 67.50.

Short with sell stop below bear flag TDOC 18.40. Buy stop 19.25.

Short with sell stop below bear flag QRVO 93.75. Buy stop 97.50.

This article requires a Chartsmarter membership. Please click here to join.

"Old Tech" Shortcomings:

- The mature, "old tech" stocks once totally in vogue are suddenly becoming shunned. They were not too long ago clamored for their defensive nature and dividend yields, but not any longer as the overall market has been shaken out too. HPQ can not blame the recent market fragilities for its softness. Its weakness began with a bearish dark cloud cover candle on 7/12 and has now shaved one-quarter off its value during a current 7-week losing streak. The stock pays a dividend yield of 4%. ORCL slumped 13% after an ill-received earnings reaction on 9/12 and it looks like it is on a collision course with the very round par number near its 200-day SMA. IBM slumped nearly 5% this week after the prior week recorded a double top just above the 150 level and it is on a 7-session losing streak. Below is the chart of CSCO and on 9/21 it completed a bearish island reversal (following the gap up on 8/17) after announcing it was purchasing SPLK. I prefer to act on these events on more mundane, generic news but this is starting to take on the look of a bear flag as well.

Seasonality Tailwinds:

- Semiconductors are an integral part of the technology space. They will often dictate the direction of the entire group and although we are all aware of how positive seasonality factors are as we usher in Q4, I did not realize just how strong they were. Starting with October over the last 4 years, it begins a period of 10 straight MONTHLY advances (where the SMH CLOSES higher than where it opened) and of course, that includes the COVID era. But more specifically the next 2 months are by far the most powerful with the October-November period averaging a combined gain of 19%, not a typo, with all of the 4 years CLOSING above where they started 100% of the time. This September lived up to its reputation of being the worst of the year up just 1 of the last 5 years and averaging a loss of nearly 5%. The 3 weeks ending between 9/8-22 lost nearly a total of 10% alone. Are too many banking on the traditional run into the final quarter or will seasonality play its familiar role? Stay tuned.

Recent Examples:

- As software attempts to stay above its August lows that we spoke about this week, I believe one could make small purchases in leaders. Some tried to put up strong moves today like PLTR but CLOSED off intraday highs to end Q3 Friday. Below is the chart of CRWD and how it appeared in our 9/28 Technology Note. This is a name that is easily classified as a leader and this past week it displayed solid relative strength up 3% while the IGV was UNCH. All of the last 4 weeks CLOSED above the top of the WEEKLY range ending 9/1 which jumped 8% in double average WEEKLY volume. The 160 level where the stock was rebuffed 4 times between late May and August now feels like a floor, or at least a very good area to play against. And as generals often do it is offering an add-on buy point on the way up through a short double bottom pivot of 171.10.

Special Situations:

Dell:

- "Old tech" play up 71% YTD and 101% over last one year period. Dividend yield of 2.1%.

- Name 6% off most recent 52-week highs (rival HPQ 24% off its annual peak and on a 7-week losing streak) and has doubled since the March lows. Digesting enormous WEEKLY cup base breakout that began at the beginning of 2022.

- Earnings reactions mostly higher up 21.2, 1.4, and 6.8% on 9/1, 6/2, and 11/22/22, and fell .9% on 3/3.

- Enter with buy stop above bull flag pivot.

- Entry DELL 70.25. Stop 67.50.

Teladoc Health:

- Software laggard down 21% YTD and 29% over the last one year period.

- Name 46% off most recent 52-week highs and much further off highs at very round 300 number from early 2021. Last week was fell 1% (on 4 week losing streak), making up none of the prior 3 weeks losing a combined 20%.

- Earnings reactions mostly higher up 26.9, 6.4, and 6.5% on 7/26, 4/27, and 10/27/22, and fell 6.8% on 2/23.

- Enter short with sell stop below bear flag.

- Entry TDOC 18.40. Buy stop 19.25.

Qorvo:

- Semi laggard up 6% YTD and 17% over last one year period.

- Name 17% off most recent 52-week highs and weak relative strength the 2 weeks ending between 9/8-15 falling a combined 12%, with the SMH falling half that amount. Has look off falling BELOW bullish WEEKLY ascending triangle.

- Earnings reactions mostly lower off .2, 5.8 and 2.1% on 8/3, 2/2 and 11/3/22 and rose .4% on 5/4.

- Enter short with sell stop below bear flag.

- Entry QRVO 93.75. Buy stop 97.50.

Good luck.

Entry summaries:

Buy stop above bull flag pivot DELL 70.25. Stop 67.50.

Short with sell stop below bear flag TDOC 18.40. Buy stop 19.25.

Short with sell stop below bear flag QRVO 93.75. Buy stop 97.50.