Regime Change:

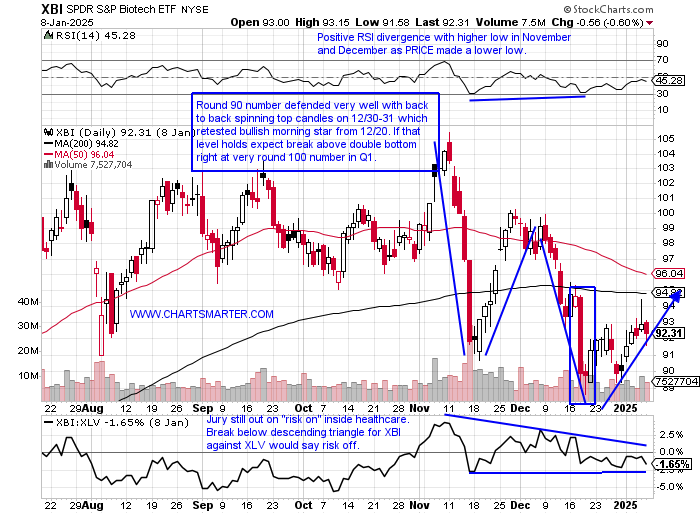

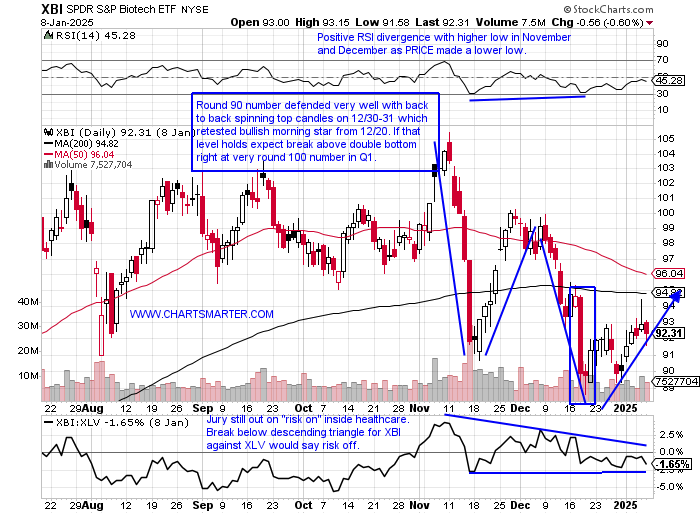

- Was it a coincidence that biotechs started to struggle mightily after the first full month in office in February 2021 a huge top for the group? Notice the cratering after the bearish shooting star that month, which started a more than 100-handle descent to the lows made in May 2022. The good sign is that it is holding north of the break ABOVE the bearish head and shoulders formation and we know from FALSE moves come fast ones in the opposite direction. It is still within the bull flag and trading in a taut range between the very round 90-100 numbers. Over the last year on an intramonth basis it traded above par 7 times, but only one month was able to CLOSE above 100, last August. Suffice to say, that is a big line in the sand going forward in 2025, and a break above carries a measured move to 135. The WEEKLY chart is a bit more ominous as it still trades below the nasty bearish engulfing candle the week ending 11/15 which slumped 12% in enormous volume. A bearish death cross is happening, but those occur after most of the technical damage has been done, and the last 3 weeks have defended the important very round 90 number. The daily chart of the XBI below shows CLOSES above 90 are imperative, as just a few below that number have occurred but the worst being 12/19 by 17 cents. Good risk/reward here for the group.

Follow the Leader?

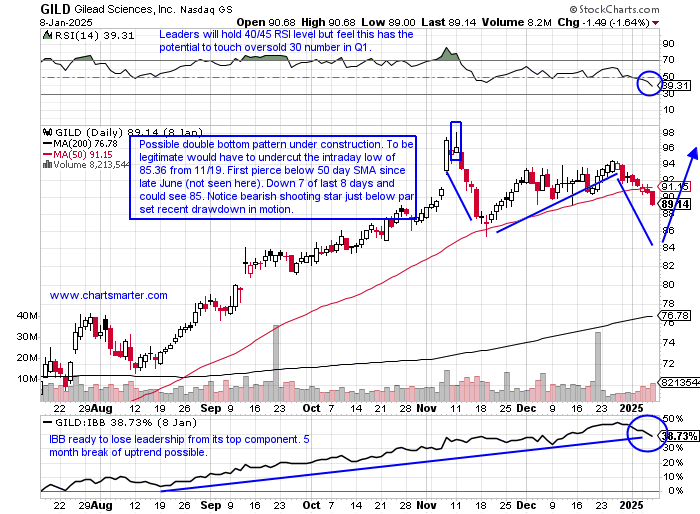

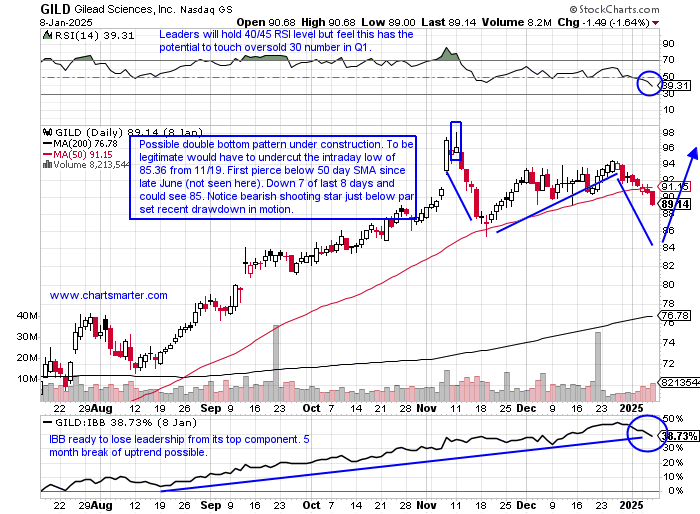

- Gilead Sciences has been the clear leader of the remaining "big three" in biotech. The performance chart over the last 200 days here shows the fact. Notice over the last couple of weeks GILD is pointing lower, as AMGN (which we will discuss later) and BIIB move upward. Biogen has been an utter disaster since last Q2 '23 after the bearish engulfing candle the week ending 6/16/23 (notice the three doji candles one year ago gave the all clear to short more one year ago after a brief dead cat bounce). The daily chart below does suggest the top holding in the IBB can drop another 3-4% from here, which would be a healthy, prudent pullback in my opinion. Will these "mega-cap" names in the space, flourish overall in 2025 with a feeling of a more appreciative M&A environment? Additionally, if one thinks rates are going to peak shortly, that would be a tailwind for the biotechs. Will there be a reversion to the mean here with the largest dispersion in PRICE in at least 6 months? Keep an eye on REGN, the third-largest holding in the IBB, if it can hold the very round 700 number here on the WEEKLY.

Recent Examples:

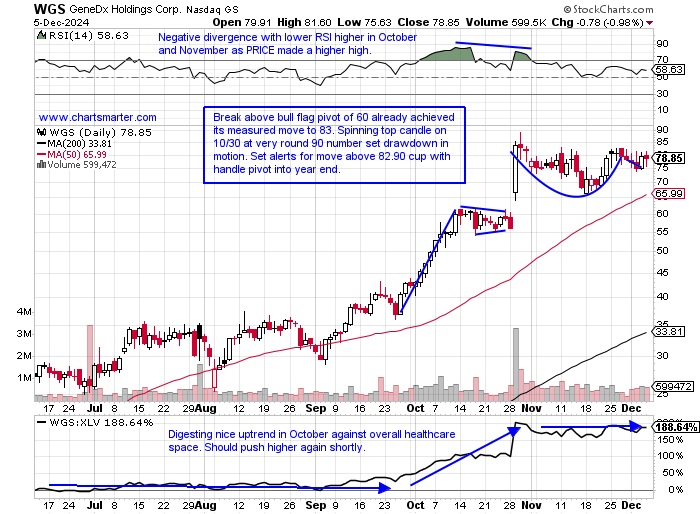

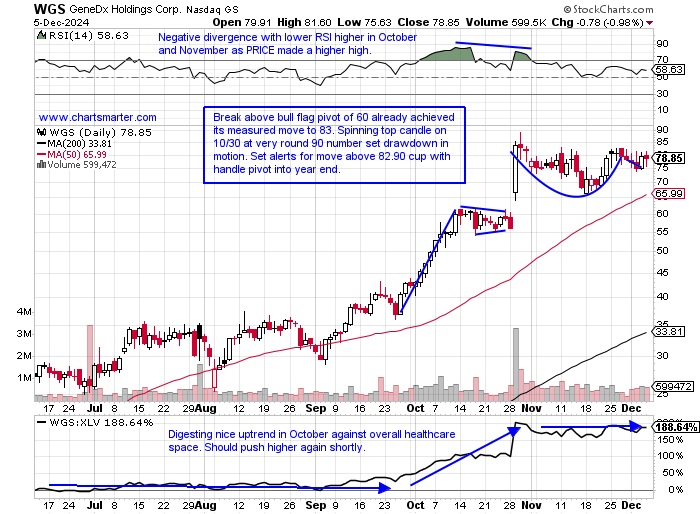

- The genomics space in general has been a mixed picture. TWST has been one of the better names and its chart has been soft since filling in an upside gap from the 8/1 session in early December. Wednesday traded deep into the bullish morning star pattern (boxed) completed on 12/20, which jumped by 10% in the best volume in more than 4 months. It has been stuck in a rough range between the round 40-50 numbers since summer and I would not be surprised with a quick undercut of recent trade back toward lower 40s to set up a potential double bottom. Below is the health information services play in the space in WGS and how it appeared in our 12/6 Healthcare Note. It is now well above the suggested 82.90 cup with handle pivot and is stalling not surprisingly at the very round par number. On 1/6 it screamed above an add-on buy cup base trigger of 89.21 jumping 13% in double average daily volume, and Tuesday and Wednesday retested it and the very round 90 figure well. Look for this to travel toward 115 by late Q1.

Special Situations:

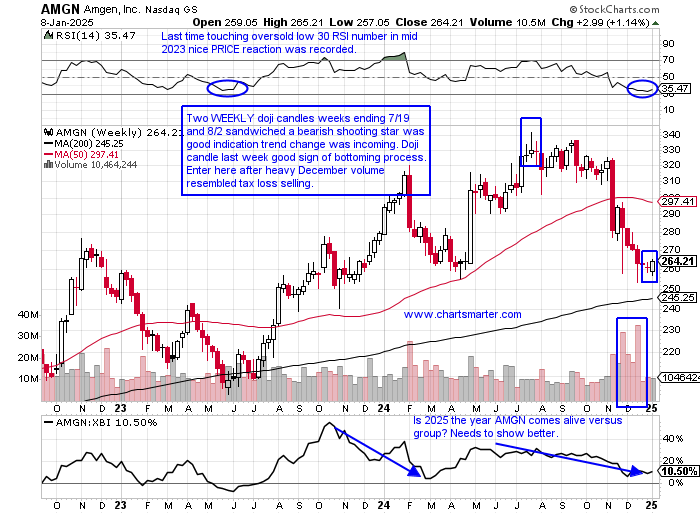

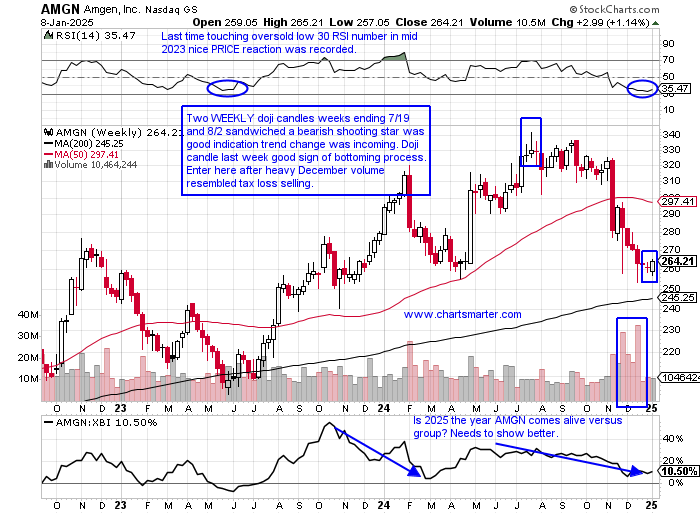

Amgen:

- Mature biotech down 14% over last one year period and 18% over last 3 months. Dividend yield of 3.6%.

- Name 24% off most recent 52-week highs and DAILY chart shows positive RSI divergence with a higher low as PRICE made a lower low in November and December. Notice bullish hammer and doji candle on 12/19 and 12/31 solidifying positive theme.

- Earnings reactions mixed up 1.5 and 11.8% on 10/31 and 5/3 and fell 5 and 6.4% on 8/7 and 2/7.

- Enter after WEEKLY doji candle.

- Entry AMGN here. Stop 255.

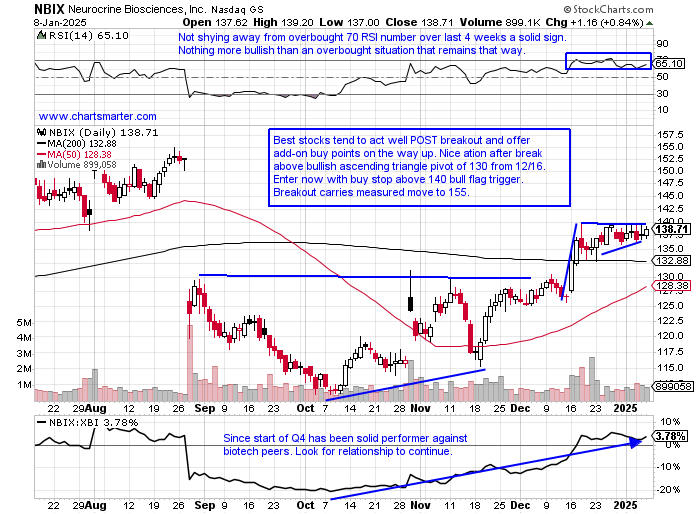

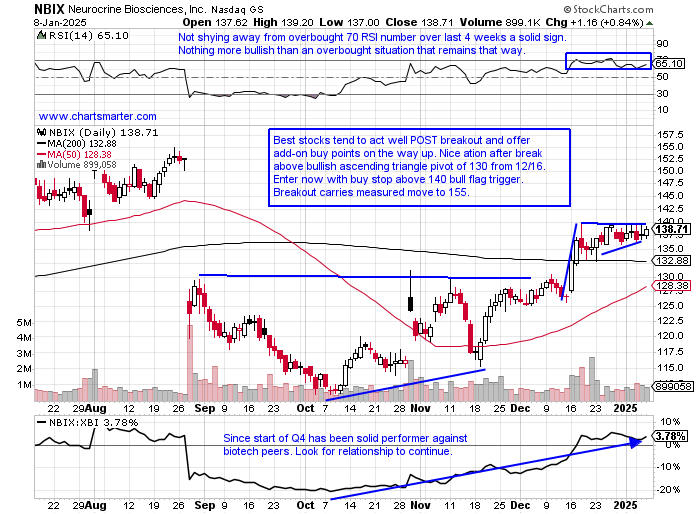

Neurocrine Biosciences:

- Biotech play up 4% over last one year period and 24% over last 3 months.

- Name 12% off most recent 52-week highs and WEEKLY chart shows potential brak above cup with handle at that round 140 number. Breakout would negate bearish harami cross (doji). Notice current pattern successfully retested late 2023 breakout.

- Earnings reactions mostly higher up 7, 8.1, and 4% on 10/30, 8/1, and 5/1 after a loss of 4.7% on 2/7.

- Enter with buy stop above bull flag.

- Entry NBIX 140.25. Stop 135.50.

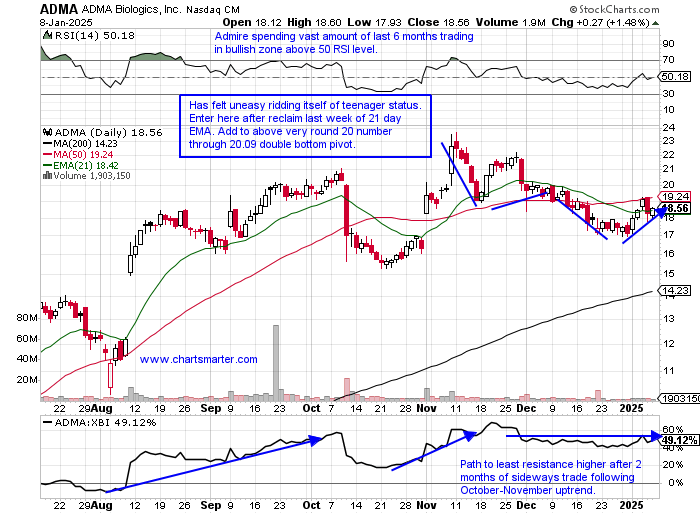

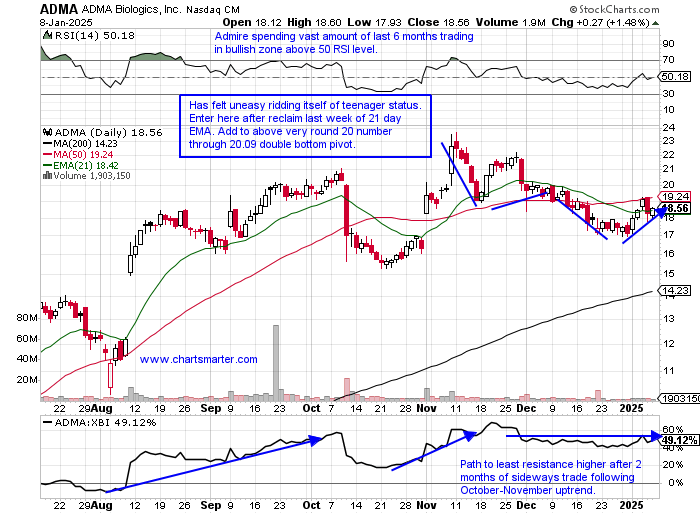

ADMA Biologics:

- Biotech play up 266% over last one year period and down 9% over last 3-month period.

- Name 21% off most recent 52-week highs and WEEKLY chart shows nice PRICE action following pit stops along rising 21 WEEK EMA over last one year period. Has quickly distanced itself from the line (circled) on previous occasions so want to see this next week push decisively off it.

- Earnings reactions mostly higher (up 13 of last 14!!) gaining 14.7, 30.9, and 27.1% on 11/8, 8/9, and 5/10.

- Enter after reclaim of 21-day EMA.

- Entry ADMA here. Stop 17.50.

Good luck.

Entry summaries:

Buy after WEEKLY doji candle AMGN here. Stop 255.

Buy stop above bull flag NBIX 140.25. Stop 135.50.

Buy after reclaim of 21-day EMA ADMA here. Stop 17.50.

This article requires a Chartsmarter membership. Please click here to join.

Regime Change:

- Was it a coincidence that biotechs started to struggle mightily after the first full month in office in February 2021 a huge top for the group? Notice the cratering after the bearish shooting star that month, which started a more than 100-handle descent to the lows made in May 2022. The good sign is that it is holding north of the break ABOVE the bearish head and shoulders formation and we know from FALSE moves come fast ones in the opposite direction. It is still within the bull flag and trading in a taut range between the very round 90-100 numbers. Over the last year on an intramonth basis it traded above par 7 times, but only one month was able to CLOSE above 100, last August. Suffice to say, that is a big line in the sand going forward in 2025, and a break above carries a measured move to 135. The WEEKLY chart is a bit more ominous as it still trades below the nasty bearish engulfing candle the week ending 11/15 which slumped 12% in enormous volume. A bearish death cross is happening, but those occur after most of the technical damage has been done, and the last 3 weeks have defended the important very round 90 number. The daily chart of the XBI below shows CLOSES above 90 are imperative, as just a few below that number have occurred but the worst being 12/19 by 17 cents. Good risk/reward here for the group.

Follow the Leader?

- Gilead Sciences has been the clear leader of the remaining "big three" in biotech. The performance chart over the last 200 days here shows the fact. Notice over the last couple of weeks GILD is pointing lower, as AMGN (which we will discuss later) and BIIB move upward. Biogen has been an utter disaster since last Q2 '23 after the bearish engulfing candle the week ending 6/16/23 (notice the three doji candles one year ago gave the all clear to short more one year ago after a brief dead cat bounce). The daily chart below does suggest the top holding in the IBB can drop another 3-4% from here, which would be a healthy, prudent pullback in my opinion. Will these "mega-cap" names in the space, flourish overall in 2025 with a feeling of a more appreciative M&A environment? Additionally, if one thinks rates are going to peak shortly, that would be a tailwind for the biotechs. Will there be a reversion to the mean here with the largest dispersion in PRICE in at least 6 months? Keep an eye on REGN, the third-largest holding in the IBB, if it can hold the very round 700 number here on the WEEKLY.

Recent Examples:

- The genomics space in general has been a mixed picture. TWST has been one of the better names and its chart has been soft since filling in an upside gap from the 8/1 session in early December. Wednesday traded deep into the bullish morning star pattern (boxed) completed on 12/20, which jumped by 10% in the best volume in more than 4 months. It has been stuck in a rough range between the round 40-50 numbers since summer and I would not be surprised with a quick undercut of recent trade back toward lower 40s to set up a potential double bottom. Below is the health information services play in the space in WGS and how it appeared in our 12/6 Healthcare Note. It is now well above the suggested 82.90 cup with handle pivot and is stalling not surprisingly at the very round par number. On 1/6 it screamed above an add-on buy cup base trigger of 89.21 jumping 13% in double average daily volume, and Tuesday and Wednesday retested it and the very round 90 figure well. Look for this to travel toward 115 by late Q1.

Special Situations:

Amgen:

- Mature biotech down 14% over last one year period and 18% over last 3 months. Dividend yield of 3.6%.

- Name 24% off most recent 52-week highs and DAILY chart shows positive RSI divergence with a higher low as PRICE made a lower low in November and December. Notice bullish hammer and doji candle on 12/19 and 12/31 solidifying positive theme.

- Earnings reactions mixed up 1.5 and 11.8% on 10/31 and 5/3 and fell 5 and 6.4% on 8/7 and 2/7.

- Enter after WEEKLY doji candle.

- Entry AMGN here. Stop 255.

Neurocrine Biosciences:

- Biotech play up 4% over last one year period and 24% over last 3 months.

- Name 12% off most recent 52-week highs and WEEKLY chart shows potential brak above cup with handle at that round 140 number. Breakout would negate bearish harami cross (doji). Notice current pattern successfully retested late 2023 breakout.

- Earnings reactions mostly higher up 7, 8.1, and 4% on 10/30, 8/1, and 5/1 after a loss of 4.7% on 2/7.

- Enter with buy stop above bull flag.

- Entry NBIX 140.25. Stop 135.50.

ADMA Biologics:

- Biotech play up 266% over last one year period and down 9% over last 3-month period.

- Name 21% off most recent 52-week highs and WEEKLY chart shows nice PRICE action following pit stops along rising 21 WEEK EMA over last one year period. Has quickly distanced itself from the line (circled) on previous occasions so want to see this next week push decisively off it.

- Earnings reactions mostly higher (up 13 of last 14!!) gaining 14.7, 30.9, and 27.1% on 11/8, 8/9, and 5/10.

- Enter after reclaim of 21-day EMA.

- Entry ADMA here. Stop 17.50.

Good luck.

Entry summaries:

Buy after WEEKLY doji candle AMGN here. Stop 255.

Buy stop above bull flag NBIX 140.25. Stop 135.50.

Buy after reclaim of 21-day EMA ADMA here. Stop 17.50.